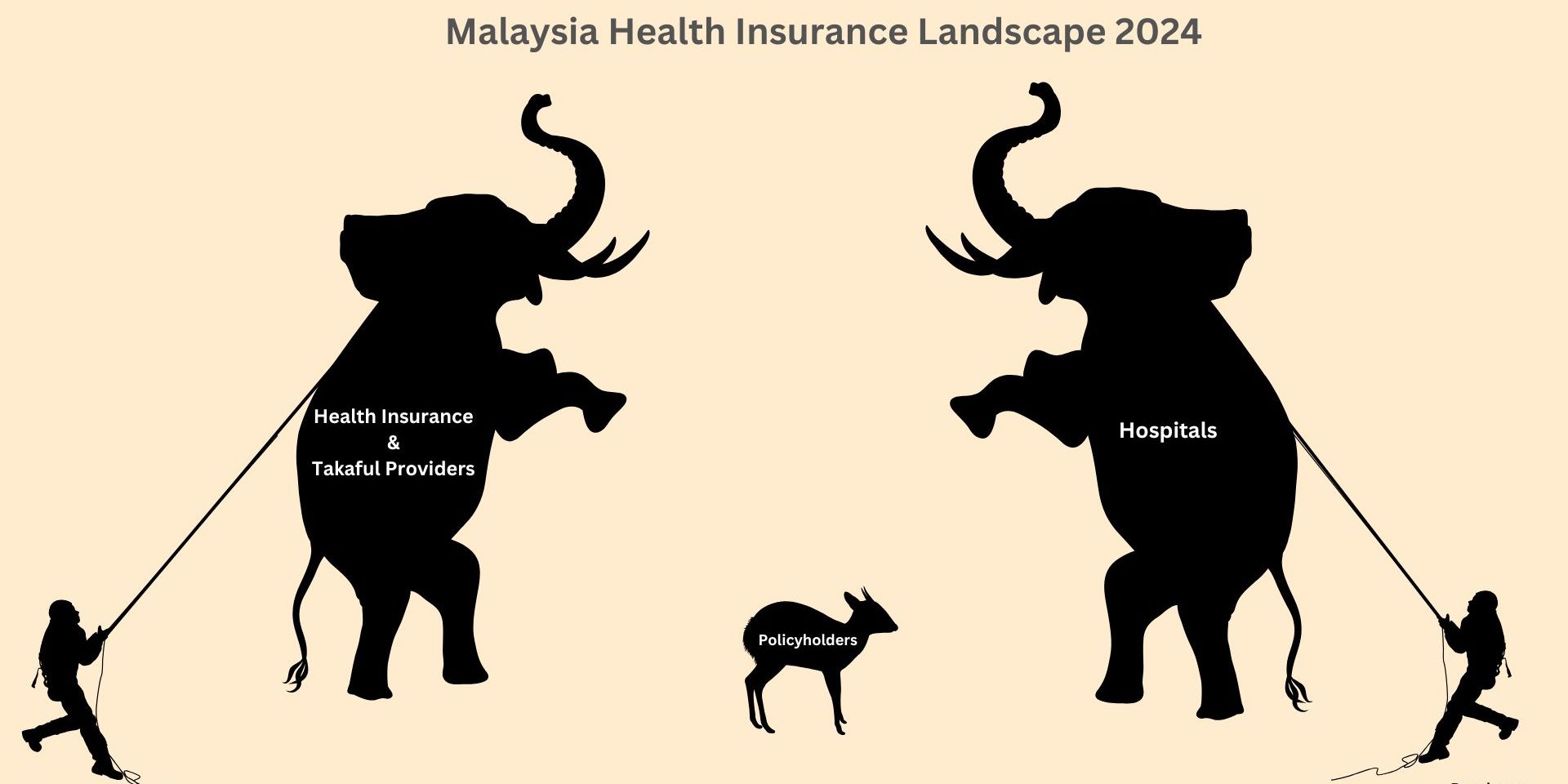

Malaysia Health Insurance Landscape

Last Thursday (28/11/2024), Bank Negara Malaysia (BNM) released a statement stating that it acknowledges the concerns relating to the repricing strategies by health insurance and takaful providers. With rising medical costs and insurance premiums at an all-time high, here is what the next few months are going to look like for the general public.

It is no doubt that this repricing is going to hurt the policyholder's wallets. Regardless of the acknowledgment by the regulators, it is going to take a gravely long time before we see an immediate resolution on the insurance policies pricing. Policyholders will have to either spend more to sustain their current policies or opt to downgrade their coverage to sustain their current budget. Lower coverage could also mean insufficient money during times of health crisis. Policyholders will also be affected emotionally, where they will need to decide what coverage or benefits they need to forgo given their current health and financial conditions. The next few months pose an extremely tough time ahead for policyholders to rationally navigate across the health insurance products and services.

We can also expect to see an endless debate and discussions on the rectification of this repricing strategy. Or in other words, the 'feedback loop of hell' will commence. Regulators are going to have an extremely difficult time in enforcing a threshold for sustainable health insurance products. Who is at fault here for this scenario? The hospitals? The insurance providers? The regulators, who should have foreseen this post-pandemic scenario? All these institutions need to cooperate and achieve synergy if they want to provide sustainable and affordable health insurance products and services to our people. Unfortunately, it's going to take years to see a positive resolution of the repricing that prioritizes the welfare of the people.

Besides that, people are going to struggle to receive proper treatments and healthcare access. Lapsation of insurance policies is going to be a common scenario in the next few years. With no coverage to pay for private hospitals, most will opt for government health care facilities. Thus, we can expect to see an influx of people heading to government hospitals. We will also witness an increase in the number of people on a waitlist for important surgeries. Due to the overwhelming increase in the number of patients being directed their way, doctors and nurses in the government healthcare facility are going to be severely overworked.

Sadly, the future looks grim in the healthcare landscape for Malaysia. Unless a dynamic and immediate enforcement is executed, this is the next few years scenario for all of us. Thus, quoting, "𝘎𝘢𝘫𝘢𝘩 𝘴𝘢𝘮𝘢 𝘨𝘢𝘫𝘢𝘩 𝘣𝘦𝘳𝘫𝘶𝘢𝘯𝘨, 𝘱𝘦𝘭𝘢𝘯𝘥𝘶𝘬 𝘮𝘢𝘵𝘪 𝘥𝘪𝘵𝘦𝘯𝘨𝘢𝘩-𝘵𝘦𝘯𝘨𝘢𝘩".