5 Things You Should Know About The New Base MHIT Medical Plan

Choosing the right medical insurance is one of the most important financial decisions you will make. With the upcoming rollout of the Base Medical and Health Insurance/Takaful (MHIT) Plan, there’s a new option now that we can consider.

Here are 5 essential things you need to know about the base plan to help you decide if it’s the right fit for you.

1. It focuses purely on medical protection

Most of the plans we see today are bundled with investment funds, which can make the monthly costs fluctuate or feel a bit confusing. This base plan is different because it is a "standalone" product. Your money goes directly toward your medical coverage, such as hospital room stays, surgery, and medications. By stripping away the investment side, the goal is to keep your protection stable and easier to manage over the long run.

2. You have two main paths to choose from

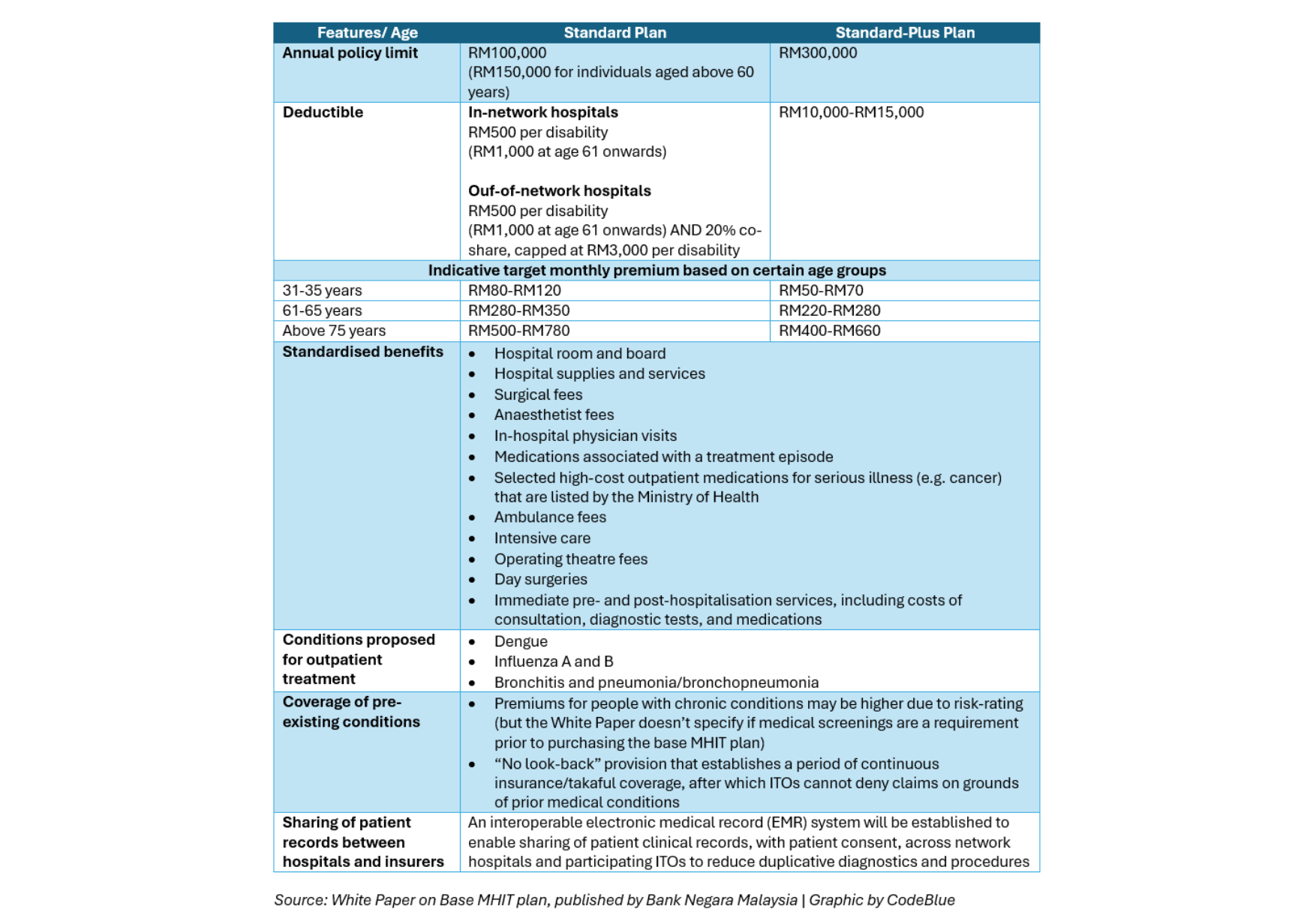

The plan is built to fit different budgets through two options. The first is the Standard Plan, which has a RM100,000 annual limit. It’s great if you want lower out-of-pocket costs when you actually go to the hospital.

The second is the Standard-Plus Plan. This is a great choice if you are on a tight budget because the monthly premiums are much lower, as low as RM50 to RM70 for younger adults. Just keep in mind that this version has a higher "deductible," meaning you pay a larger portion of the bill yourself before the insurance takes over the rest.

3. Staying "in-network" saves you money

To help keep costs down for everyone, the plan encourages you to use specific hospitals that have agreed to be transparent with their pricing. If you go to one of these "in-network" hospitals, you’ll usually just pay a small fixed amount, like RM500, toward your bill. If you choose a hospital outside this network, you might have to pay a percentage of the total bill yourself. It’s a simple way to stay in control of your expenses.

4. It’s a safety net for your existing policy

If you already have a medical plan but find that the price is becoming too expensive every year, this base plan offers a unique "safety valve." The rules are being set up so that you can switch from your current expensive plan to this base plan with the same insurance company. The best part is that you can often do this without having to go through new medical checkups, which is a huge relief if you’ve developed any health issues over the years.

5. You can use your EPF to help pay for it

One of the most helpful features being planned is the ability to pay your premiums using your EPF Account 2. This is a game-changer for people who want to make sure they are protected but don't want to stretch their monthly take-home pay too thin. It makes private healthcare more accessible by using savings you already have set aside for your future well-being.

The Base MHIT plan is all about giving you a solid foundation. While it doesn't cover every single luxury, it is designed to handle the vast majority of medical situations that people actually face.